About

Bio

Background and Format:

The International Tax Report is a specialist monthly newsletter that provides an analysis of the implications of tax developments worldwide. It covers issues including foreign investment, transfer pricing, tax havens, offshore companies, tax treaties, anti-avoidance issues, non-residential taxation and corporate planning.

Audience and Readership:

Tax professionals involved in transnational or cross-border, commercial or investment activities and transactions.

Frequency:

10 issues per year.

Circulation:

A figure is not disclosed.

Distribution:

Available via subscription in print and online.

Other Information:

Editorial content is commissioned by Informa.

Alerts:

Gorkana Alert: Monday 21st November 2005

The editorship of the International Tax Report newsletter published by Informa will be changing hands at the end of this year.

As of 2006 Jorge Guira, an experienced US lawyer based in the UK, will be editing the monthly tax title. Jorge teaches international corporate finance, banking and securities at Warwick Univeristy and the University of London, and has assisted in structuring deals for major firms in leveraged finance, m/a, private equity, and structured finance, globally. Jorge is currently commissioning articles for his first issue as editor, which will be February 2006. If you would like to contribute to that or any future issue Jorge can be contacted at jorge.guira@warwick.ac.uk

Email

email@cision.one

Website

site@cision.one

Social media

Location

United Kingdom

Frequency

upgrade

Circulation

upgrade

Sectors

Accounting

Bio

Background and Format: The International Tax Report is a specialist monthly newsletter that provides an analysis of the implications of tax developments worldwide. It covers issues including foreign investment, transfer pricing, tax havens, offshore companies, tax treaties, anti-avoidance issues, non-residential taxation and corporate planning. Audience and Readership: Tax professionals involved in transnational or cross-border, commercial or investment activities and transactions. Frequency: 10 issues per year. Circulation: A figure is not disclosed. Distribution: Available via subscription in print and online. Other Information: Editorial content is commissioned by Informa. Alerts: Gorkana Alert: Monday 21st November 2005 The editorship of the International Tax Report newsletter published by Informa will be changing hands at the end of this year. As of 2006 Jorge Guira, an experienced US lawyer based in the UK, will be editing the monthly tax title. Jorge teaches international corporate finance, banking and securities at Warwick Univeristy and the University of London, and has assisted in structuring deals for major firms in leveraged finance, m/a, private equity, and structured finance, globally. Jorge is currently commissioning articles for his first issue as editor, which will be February 2006. If you would like to contribute to that or any future issue Jorge can be contacted at jorge.guira@warwick.ac.uk

Website

Social media

Location

Frequency

Circulation

Sectors

Accounting

Most recent articles by International Tax Report

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Explore outlets similar to International Tax Report

-

Bloomberg Industry Group

Bloomberg Industry GroupBloomberg Industry Group empowers professionals in government, law, tax & accounting, and environment with essential data, news, and analysis.

View Journal of Accountancy

Journal of AccountancyEstablished in 1905. Serves certified public accountants (CPAs), public accountants, business executives, government officials, educators, financial planners and others in accounting and related fields. Covers all topics related to accounting including financial reporting, auditing, taxation, personal financial planning, technology, professional development, consulting, practice management, education and related business and international issues. Focuses on practical situations and applications, and offers insights and advice which is useful to readers and can be applied in practice. Sections include: Tax Matters, focusing on technical tax coverage that affects CPAs; Tax Practice Corner, covering common tax issues pertaining to clients; Technology Q&A, featuring accounting and financial technologies; Bookshelf Review, reviewing industry books; News Digest, covering breaking news coming out of the accounting and financial industries; Highlights, including news of interest to practicing CPAs and financial professionals; and Last Word, with features and profiles of CPAs.

View The Balance

The BalanceThe outlet covers money in a personal way including topics on Personal Finance, Budgeting, Home buying, Retirement, Freebies, Frugal Living, Coupons, Career, Small business, Investing and more.

View TMT Finance

TMT FinanceBackground and Format: Founded in October 2008, TMT Finance provides specialist news, research, networking and knowledge sharing events. As well as the portal, TMT products also include a newsletter, conferences, award ceremonies and market reports. They provide insight and intelligence on new opportunities in growth markets in the telecom, media and technology sectors. Audience and Readership: Senior executives from the telecom, finance and professional advisory community globally. Monthly Unique Users: The publisher does not disclose the monthly unique user figure. Ad rates: Information on ad rates are not disclosed. Other information: The TMT Finance News Newsletter is now published weekly. It used to be sent out fortnightly.

View CPA Practice Advisor

CPA Practice AdvisorEstablished in 1991 as The CPA Technology Advisor. Designed to simplify software purchasing decisions for public accounting firms. Contains reviews of software used in these firms, as well as software which may be recommended to clients. Includes detailed charts, graphs and tables for a comparative look at software, along with features on industry trends, marketing, practice management and technology updates. Aims to be an independent voice for accountants' software and helps accountants implement software usage in their offices. Offers independent and in-depth comparisons, product reviews, charts, tables and graphs related to accounting software and other accounting issues.

ViewUse CisionOne to find more relevant outletsExplore journalists that write for International Tax Report

-

K

Contact us to find more relevant journalistsContact International Tax Report and get access to over 850K accurate, up-to-date media profiles.

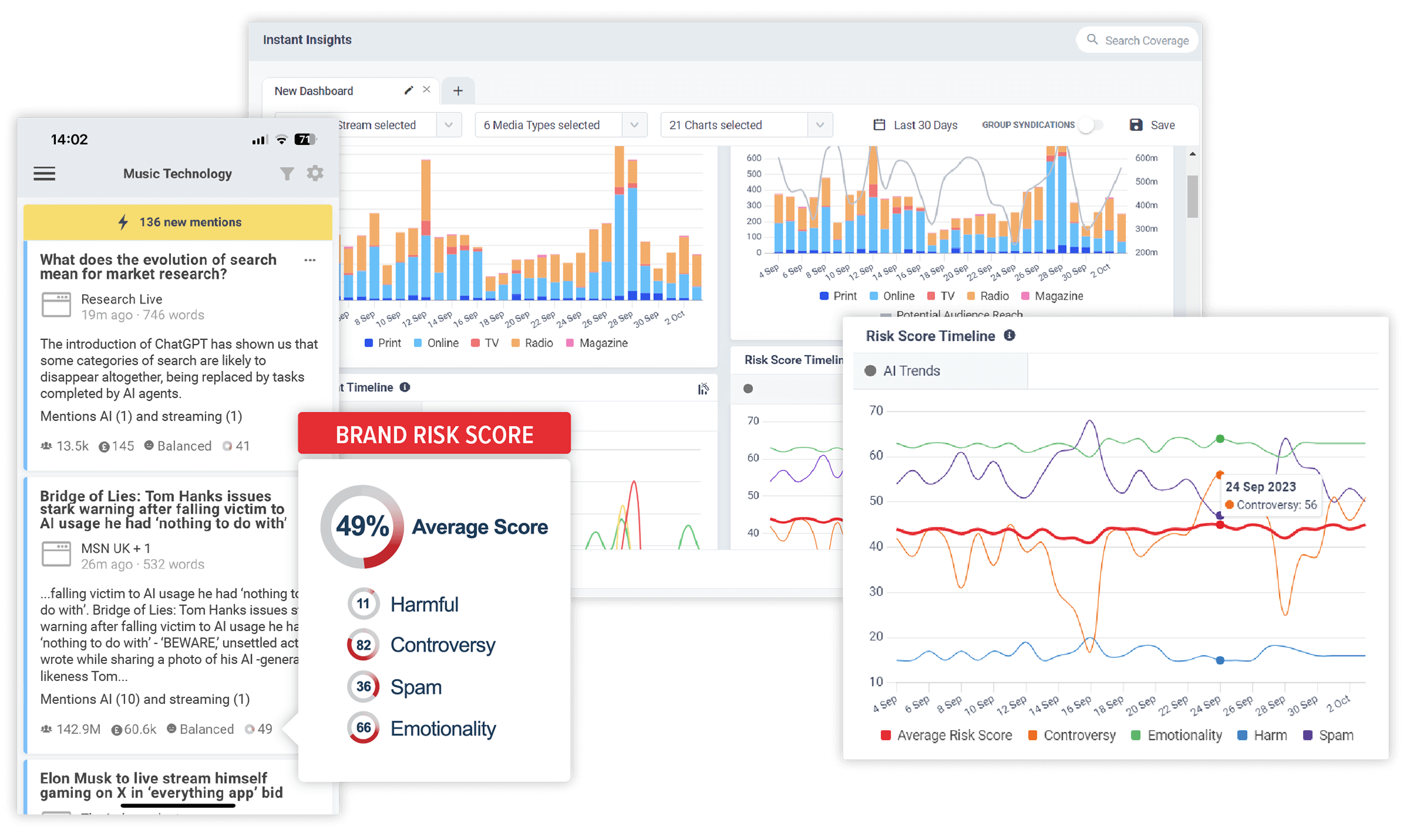

Discover the stories that impact your brand. In realtime.

CisionOne delivers relevant news, trends and conversations that matter to your brand with the world’s most comprehensive media monitoring service across Print, Online, TV, Radio, Social, Magazines, Podcasts and more.