About

Bio

Background and Format:

Since its founding in 1985, the International Swaps and Derivatives Association has worked to make over-the-counter (OTC) derivatives markets safe and efficient. The website contains news and a press release function. There is also a newsletter, ISDA in Review is a monthly compendium of links to new documents, research papers, press releases and comment letters from the Association. It is emailed at the close of each month to members, as a benefit of enrolment.

Audience and Readership:

OTC derivatives market participants including corporations, investment managers, government and supranational entities, insurance companies, energy and commodities firms, and international and regional banks.

Deadline:

Ongoing

Monthly Unique Users:

The monthly unique user figure is unavailable.

Supplements and Sections:

media.comment (isda.mediacomment.org) is a blog which addresses mainstream business and financial media coverage of the derivatives industry, to create a more informed debate and understanding of the OTC derivatives markets for all our audiences.

derivatiViews (isda.derivativiews.org) is a blog where ISDA Chief Executive Officer Robert Pickel and Deputy Chief Executive Officer George Handjinicolaou offer informal comments on important OTC derivatives issues in derivatiViews, reflecting ISDA's long-held commitment to making the market safer and more efficient.

SDA in Review is a monthly compendium of links to new documents, research papers, press releases and comment letters from the Association. It is emailed at the close of each month to members, as a benefit of enrollment.

Commodity fact is an affiliated blog (www.commodityfact.org)

ISDA dailyLead is a free daily e-letter including coverage for the global

derivatives industry. Partnered with SmartBrief.

Other Information:

The ISDA company press releases can be viewed here.

Email

email@cision.one

Website

site@cision.one

Social media

Location

United Kingdom

Frequency

upgrade

Circulation

upgrade

Sectors

Derivatives

Bio

Background and Format: Since its founding in 1985, the International Swaps and Derivatives Association has worked to make over-the-counter (OTC) derivatives markets safe and efficient. The website contains news and a press release function. There is also a newsletter, ISDA in Review is a monthly compendium of links to new documents, research papers, press releases and comment letters from the Association. It is emailed at the close of each month to members, as a benefit of enrolment. Audience and Readership: OTC derivatives market participants including corporations, investment managers, government and supranational entities, insurance companies, energy and commodities firms, and international and regional banks. Deadline: Ongoing Monthly Unique Users: The monthly unique user figure is unavailable. Supplements and Sections: media.comment (isda.mediacomment.org) is a blog which addresses mainstream business and financial media coverage of the derivatives industry, to create a more informed debate and understanding of the OTC derivatives markets for all our audiences. derivatiViews (isda.derivativiews.org) is a blog where ISDA Chief Executive Officer Robert Pickel and Deputy Chief Executive Officer George Handjinicolaou offer informal comments on important OTC derivatives issues in derivatiViews, reflecting ISDA's long-held commitment to making the market safer and more efficient. SDA in Review is a monthly compendium of links to new documents, research papers, press releases and comment letters from the Association. It is emailed at the close of each month to members, as a benefit of enrollment. Commodity fact is an affiliated blog (www.commodityfact.org) ISDA dailyLead is a free daily e-letter including coverage for the global derivatives industry. Partnered with SmartBrief. Other Information: The ISDA company press releases can be viewed here.

Website

Social media

Location

Frequency

Circulation

Sectors

Derivatives

Most recent articles by ISDA

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Explore outlets similar to ISDA

-

IInternational Financing Review

Background and Format: Refinitiv International Financing Review is the leading source of fixed income, capital markets and investment banking news and commentary. IFR's team of market specialists report on capital raising across asset classes, from rumour through to market reception - in real-time, online, on mobile, in print - and now in Refinitiv Eikon. IFR's special reports, roundtables and conferences provide expert thought leadership to a senior financial markets audience; IFR Awards are the industry's most prestigious. Markets professionals worldwide rely on IFR's combination of commentary, analysis, data and forecasting for intelligence they can act on. The press deadline falls on a Friday, with the magazine published on Mondays. Circulation: Source: Publisher Monthly Unique Users: The publisher does not disclose this figure. Other Information: Refinitiv IFR is headquartered in London and has editorial bureaux in Tokyo, Hong Kong, New York, Boston, Frankfurt, Singapore and Sydney. Refinitiv IFR Awards: Deals of the Year - January It is best to contact the team individually via their direct lines, rather than go through the switchboard. Alerts: Gorkana Alert: Thursday 28th May 2009 IFR has re-launched its debt restructuring section covering the global restructuring space, including: debt for equity swaps; debt buybacks and exchange offers; distressed refinancings and distressed debt trading. Hicham Kantar has joined IFR as Senior Reporter covering EMEA restructuring, joining Donal O'Donovan in London and Philip Scipio in New York. Hicham was previously an Investment Banker in London and worked on M&A and leveraged finance transactions. Donal, previously Senior Reporter covering European leveraged loans and high-yield bonds has been covering EMEA restructuring since March 2009. Philip Scipio will continue to cover US restructurings from New York. Donal can be reached on +44 (0)20 7369 7802 and donal.odonovan@thomsonreuters.com Hicham can be reached on +44 (0)20 7369 7564 and hicham.kantar@thomsonreuters.com Philip can be reached on +1 (646) 223 8767 and philip.scipio@thomsonreuters.com Gorkana Alert: Thursday 2nd April 2009 The New York bureau of International Financing Review has a new office address along with new staff telephone numbers. The new IFR address is: 3 Times Square, 18th Floor New York, NY 10036 Contact information for staff is: Stephen Lacey, U.S. Editor, can be reached on +1 (646) 223 8808 and stephen.lacey@thomsonreuters.com Joy Ferguson, Reporter, can be reached on +1 (646) 223 8566 and joy.ferguson@thomsonreuters.com Paul Kilby, Assistant Editor, can be reached on +1 (646) 223 8704 and paul.kilby@thomsonreuters.com Christopher Langner, Reporter, can be reached on +1 (646) 223 8486 and christopher.langner@thomsonreuters.com Christian Murray, Reporter, can be reached on +1 (646) 223 4183 and christian.murray@thomsonreuters.com Philip Scipio, Reporter, can be reached on +1 (646) 223 8767 and philip.scipio@thomson

View Risk.net

Risk.netBackground and Format: Risk.net is a financial risk management news & analysis online gateway. It provides access to a range of premium content covering the international financial risk management sector. The premium content includes over fifty additional news articles from Risk.net brands including Asia Risk, Energy Risk, Insurance Risk, Operational Risk & Regulation, Risk and Structured Products. Audience and Readership: For risk management, derivatives & regulation professionals globally. Monthly Unique Users: This figure is not made available. Ad Rates: Advertising information can be requested here. Awards: 2019 - AOP Digital Publishing Awards, Best Online Brand: B2B (winner) 2019 - AOP Digital Publishing Awards, Best Digital Publishing Innovation: Selling Engaged Time Or Cost Per Hour (CPH) To The Banking Industry (nominated) 2017 - PPA Awards, Business Information Brand of the Year (nominated) 2017 - AOP Digital Publishing Awards, Best Online Media Property / Brand B2B (nominated) 2017 - British Media Awards, Event of the Year: Risk USA (nominated) 2017 - British Media Awards, Media Brand of the Year (nominated) 2016 - AOP Digital Publishing Awards, Best Online Media Property / Brand (B2B) (nominated) 2016 - AOP Digital Publishing Awards, Digital Editorial / Audience Development Team of the Year (B2B) (nominated) 2012 - AOP Awards, Website - Business (nominated) Gorkana meets...Duncan Wood, Risk.net, April 2016 The write up can be viewed here. Other information: In November 2015, Risk restructured completely and all the titles were integrated into one brand - though they still exist as separate publications, they all share a single newsroom, grouped into five desk. Three of the desks focus on the core topics of risk management, derivatives and regulation, while two other desks focus on those topics for specific audience groups: asset managers and life insurers, and commodities market participants. Bureau Chiefs in London, New York and Hong Kong manage across all of the desks. Alerts: Gorkana UK Financial Alert: Tuesday 28th March 2017 Incisive Media has sold its Insight division, which includes the Risk.net and Insurance Post brands, to French business-to-business (B2B) publisher Infopro Digital. The acquisition deal completes on 13 April 2017. Incisive Media’s Business division, which includes the Investment Week, Professional Adviser and Professional Pensions brands, is not affected by the deal. The full announcement can be found here. Gorkana UK Financial Alert: Tuesday 17th November 2015 There has been a reorganisation across Risk.net and its print titles, comprising Risk, Asia Risk, Energy Risk, Operational Risk, Structured Products, Insurance Risk, Hedge Funds Review and Custody Risk. All content - print and digital - is now the product of a single newsroom, which is grouped into five desks. Three of the desks focus on the core topics of risk management, derivatives and regulation, while two other desks focus on those topi

View GlobalCapital

GlobalCapitalBackground and Format: Previously titled EuroWeek, GlobalCapital is a weekly magazine that provides information on the global capital markets spanning Asia, the Middle East, Europe, Africa and the Americas. Since relaunching as GlobalCapital in February 2014, the title has incorporated AsiaMoney, Derivatives Week and Total Securitization. It is published by Euromoney Institutional Investor plc. Audience and Readership: The magazine is aimed at capital markets professionals Deadline: The editorial deadline is Thursday, in the week before Easter the deadline is on a Wednesday. Time of Publication: The magazine is published on Friday. Frequency: Weekly, plus daily email bulletins covering EM, FIG, loans, leveraged loans, corporate bonds, SSA bonds, derivatives, equities and structured finance in the EU and US. Circulation: Source: Publisher. Distribution: The magazine is available via subscription in print and digital format. Ad rates: Ad and sponsorship contacts can be viewed here Alerts: Gorkana Alert: Monday 3 March 2014 EuroWeek is relaunching today as GlobalCapital. The new title also incorporates AsiaMoney, Derivatives Week and Total Securitization and is the launch platform for GlobalRMB, a news and data service on the offshore renminbi market. GlobalCapital will also continue to take the form of a weekly print title covering global capital markets. The website for GlobalCapital can now be found at www.globalcapital.com. Managing Editor Toby Fildes can be reached on +44 (0)20 7779 7327 and toby.fildes@globalcapital.com Gorkana Alert: Tuesday 7 May 2013 EuroWeek’s Oliver West has relocated to Bogotá, Colombia, to be Latin America Correspondent covering LatAm capital markets. He was previously a Leveraged Finance Reporter in London. EuroWeek has expanded its coverage to include LatAm news in its daily Emerging Markets e-mail bulletin, as well in the weekly print magazine. For LatAm news Oliver can now be reached on +57 304 382 7873 and owest@euroweek.com Gorkana Alert: Tuesday 2nd June 2009 EuroWeek and Emerging Markets have new telephone numbers. The switchboard is +44 (0)20 7779 8888 The rest of the staff can be reached as follows: EuroWeek: Brendan Daly, MTNs & CP Reporter, +44 (0)20 7779 7311 Chris Dammers, Structured Finance Editor, Regulation Reporter, +44 (0)20 7779 7312 Francesca Young, MTN Editor, +44 (0)20 7779 7313 Helene Durand, Fixed Income Editor, +44 (0)20 7779 7314 Jo Richards, Contributing Editor, Bond Reporter +44 (0)20 7779 7315 Joanne O’Connor, Emerging Markets Editor, Bond Reporter, +44 (0)20 7779 7316 Molly Guinness, Bond Reporter, +44 (0)20 7779 7317 Neil Day, Contributing Editor, Covered Bonds, +44 (0)20 7779 7318 Nick Jacob, Editor, +44 (0)20 7779 7319 Nina Flitman, Bond Reporter, +44 (0)20 7779 7320 Paul Wallace, Loans Reporter, +44 (0)20 7779 7321 Robert Vielhaber, Equities Reporter, +44 (0)20 7779 7322 Sarah White, Loans Editor, +44 (0)20 7779 7323 Simon Boughey, Freelance Writer, US bonds, +44 (0)20 7779

View Waters Technology

Waters TechnologyBackground and Format: Waters Technology is a monthly magazine, Since its launch in 1993, it has been relied on by financial technology professionals worldwide for focused, in-depth coverage of financial market data and technology. The financial services industry spends more on technology than any other. Banks and investment banks — whether global or regional — rely on technology to help keep their traders ahead of the competition. As firms trade up their systems, Waters defines the challenges that the top global financial services confront, be they old school issues like trading room systems and operations or new business propositions like consortia portals and e-commerce spin-offs. As Waters Technology covers the current moves in the market, there is no editorial calendar but they do publish reports. It is based in London and New York. It is aimed at financial technology professionals. Their copy deadline falls in the first week of the month. Circulation: Source: Publisher Ad Rates: More information can be found at http://solutions.risk.net/

View SCI (Structured Credit Investor)

SCI (Structured Credit Investor)Background and Format:Structured Credit Investor (SCI) is an online resource that provides news, event information and market data for the securitisation financial sector. Its news section covers the latest issues affecting investors, such as regulation, risk management and secondary trading. The market data section covers pipeline deals, loan defaults, price moves and industry job moves.Audience and Readership:Subscribers are financial professionals with an interest in global securitisation markets.Monthly Unique Users:Source: Publisher. 27,000 page views Average sessions 6 minutesAd Rates:For advertising information and contact details, please click here.Other Information:Structured Credit Investor also hosts seminars in London and New York, where current issues of concern are discussed by panels of industry experts.Media AlertsUK Financial Alert: Wednesday 9th May 2018SCI (Structured Credit Investor) has moved address. The team are now based at 55 Goswell Road, London, EC1V 7EN. All email addresses and phone numbers remain the same.

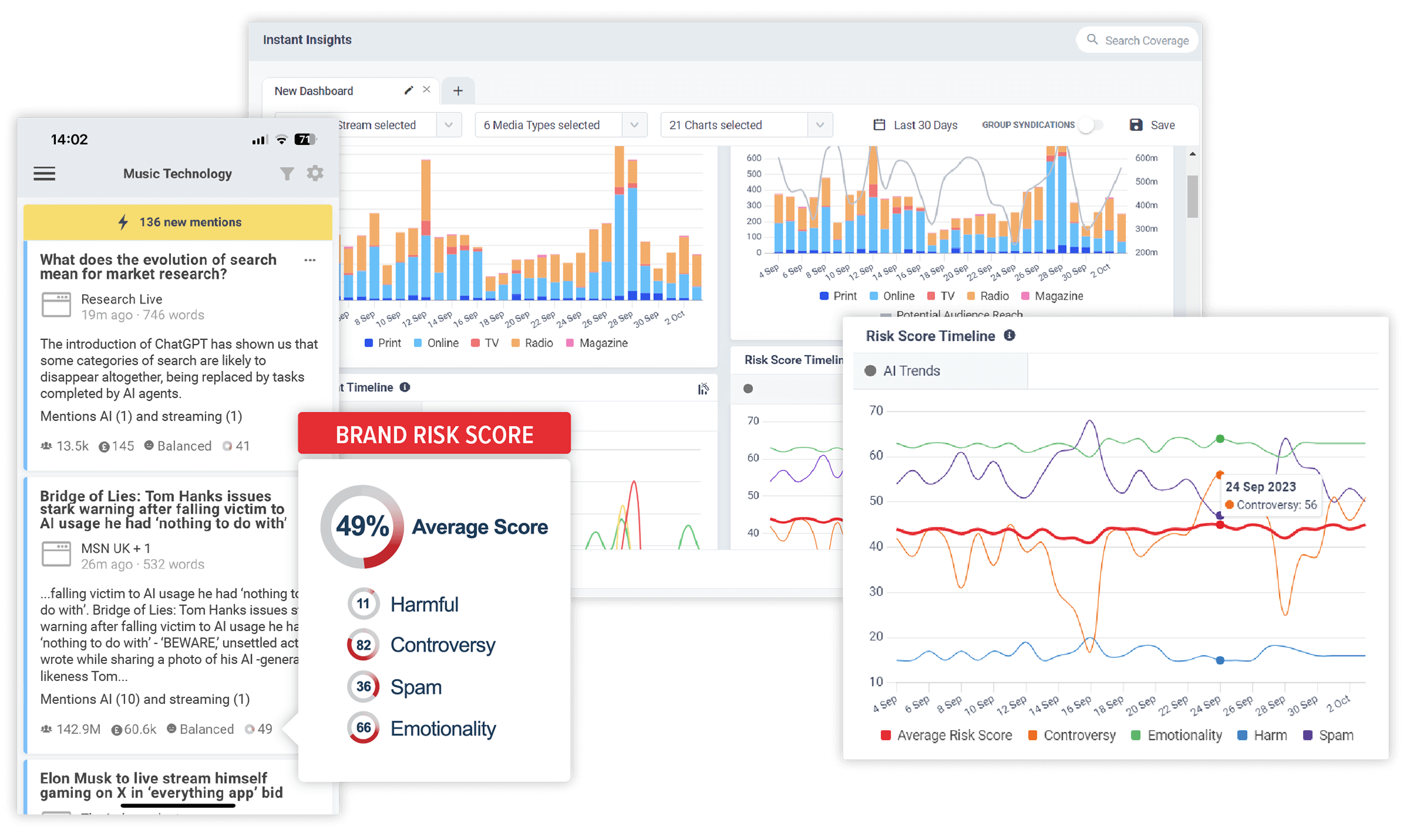

ViewUse CisionOne to find more relevant outletsDiscover the stories that impact your brand. In realtime.

CisionOne delivers relevant news, trends and conversations that matter to your brand with the world’s most comprehensive media monitoring service across Print, Online, TV, Radio, Social, Magazines, Podcasts and more.