About

Bio

TaxAssist Accountants is an accountancy and tax service for small business. Its blog acts an advisory tool.

Jo Nockels writes the posts and is the Communications Manager for TaxAssist Accountants - as well as Head Writer for the firm's editorial team. She has been a practising Accountant and is a member of ACCA and AAT. Jo is also joined by Anthony Burns, Thomas Fletcher, Emily Smith, Emma Clarke and Jacob Williams.

Blog posts take a Q&A format - and vary in length. There are also Latest News and Latest Articles sections. The blog posts are updated several times a month, with some days having more than one post published.

There are no regular PR opportunities, but PRs are asked to become well acquainted with the Blog before approaching, contact can be made by email or telephone.

Email

email@cision.one

Website

site@cision.one

Social media

Location

United Kingdom

Frequency

upgrade

Circulation

upgrade

Sectors

Accounting, Tax Law

Bio

TaxAssist Accountants is an accountancy and tax service for small business. Its blog acts an advisory tool. Jo Nockels writes the posts and is the Communications Manager for TaxAssist Accountants - as well as Head Writer for the firm's editorial team. She has been a practising Accountant and is a member of ACCA and AAT. Jo is also joined by Anthony Burns, Thomas Fletcher, Emily Smith, Emma Clarke and Jacob Williams. Blog posts take a Q&A format - and vary in length. There are also Latest News and Latest Articles sections. The blog posts are updated several times a month, with some days having more than one post published. There are no regular PR opportunities, but PRs are asked to become well acquainted with the Blog before approaching, contact can be made by email or telephone.

Website

Social media

Location

Frequency

Circulation

Sectors

Accounting, Tax Law

Most recent articles by TaxAssist Accountants

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Explore outlets similar to TaxAssist Accountants

-

Bloomberg Industry Group

Bloomberg Industry GroupBloomberg Industry Group empowers professionals in government, law, tax & accounting, and environment with essential data, news, and analysis.

ViewTThe Chronicle of PhilanthropyThe Chronicle of Philanthropy provides news and information for non-profit executives, fundraisers, and professional employees of foundations. The publication covers trends in giving, fundraising, grant making, volunteers, management and professional development. Regular features include profiles of foundations, updates on federal and state regulations, tax and court rulings, and a calendar of events. Unless something is urgent, they prefer contact by email rather than phone. Press Releases should be relevant to nonprofit practitioners across the country, and if there's been a recent article about a similar development at a different organization, they probably won’t cover it again soon. They like: stories about best or innovative practices in fundraising and managing organizations, profiles of interesting charity leaders, fundraisers, and donors, and new trends in giving or fundraising. They usually don’t cover: galas, celebrity events, groundbreakings and ribbon cuttings, and gifts of less than $1 million. The Chronicle’s Opinion section is designed to spark robust debate about all aspects of the nonprofit world. They welcome Op-Ed submissions that provide new insights and promote innovative thinking about leadership, fundraising, grant-making policy, and more. They especially appreciate articles about timely topics. Most of the pieces are about 1,000 to 1,200 words.

View Thomson Reuters Foundation

Thomson Reuters FoundationBackground and Format The Thomson Reuters Foundation, the charitable arm of Thomson Reuters, covers the world’s under-reported stories, with a global team of about 40 staff journalists on humanitarian crises, women’s empowerment, the human impact of climate change, property rights, and trafficking and slavery. All of its stories are published on its news website, news.trust.org, as well as distributed on the Reuters news wire. Established in 1983 as a training programme for journalists in developing countries, the Thomson Reuters Foundation promotes free, independent journalism through its continued training programmes and also acts to promote socio-economic progress worldwide. As well as its news service and journalism training, the Foundation runs Trust Law - which connects law firms providing pro bono work to NGOs and social enterprises - and holds the annual Trust Women conference focused on empowering women and combating trafficking and slavery. Trust.org is the Foundation’s main website. Audience and Readership: People interested in humanitarian stories as well as campaigners and lawyers along with people working in law enforcement, politics and global business. Deadline: Best to contact in the morning. Frequency: Daily - online. Monthly Unique Users: This figure is not available. Distribution: Content is produced for the website and also distributed through the Reuters news wire. Awards: 2013 - Online Media Awards, Best National/World News Site: for Aswat Masriya (nominated) Other Information: The Foundation hold an annual conference called Trust Women which brings together campaigners, filmmakers, lawyers, senior figures from law enforcement, politics, the judiciary and global business to take action to advance the status of women and their rights. PRs can get involved by sending us ideas for speakers - individuals who are leaders in their field – to media.foundation@thomsonreuters.com. It also provides the TrustLaw global pro bono legal programme connecting NGOs and social entrepreneurs with big law firms. They like to receive new ideas from PRs and quirky stories. Embargoed content is preferable - or to at least receive a story well ahead of time. They're particularly interested in 'people stories', a story that has a human face. Whatever they receive, it must fit into their remit, content has to have a global view and focus on under reported stories, humanitarian relief, governance, trafficking and slavery, and must promote socio-economic progress. The team are also available to moderate at presentations and conferences if it can promote the Foundation.

View Tax Notes

Tax NotesServes tax practitioners and policymakers with inside information on critical tax law information and important policy changes. Provides comprehensive coverage of tax news and issues. Features in-depth articles, special reports and commentary analyzing proposed and enacted tax legislation, court decisions, regulations and other administrative guidance and new trends in the administration of tax law. Contains articles by tax experts as well as the nation's leading practitioners, academics and policy experts. Tax Analysts, publisher of Tax Notes, does NOT release readership or circulation numbers. Tax Notes DOES accept bylined articles/submissions via their website.

View Journal of Accountancy

Journal of AccountancyEstablished in 1905. Serves certified public accountants (CPAs), public accountants, business executives, government officials, educators, financial planners and others in accounting and related fields. Covers all topics related to accounting including financial reporting, auditing, taxation, personal financial planning, technology, professional development, consulting, practice management, education and related business and international issues. Focuses on practical situations and applications, and offers insights and advice which is useful to readers and can be applied in practice. Sections include: Tax Matters, focusing on technical tax coverage that affects CPAs; Tax Practice Corner, covering common tax issues pertaining to clients; Technology Q&A, featuring accounting and financial technologies; Bookshelf Review, reviewing industry books; News Digest, covering breaking news coming out of the accounting and financial industries; Highlights, including news of interest to practicing CPAs and financial professionals; and Last Word, with features and profiles of CPAs.

ViewUse CisionOne to find more relevant outletsContact TaxAssist Accountants and get access to over 850K accurate, up-to-date media profiles.

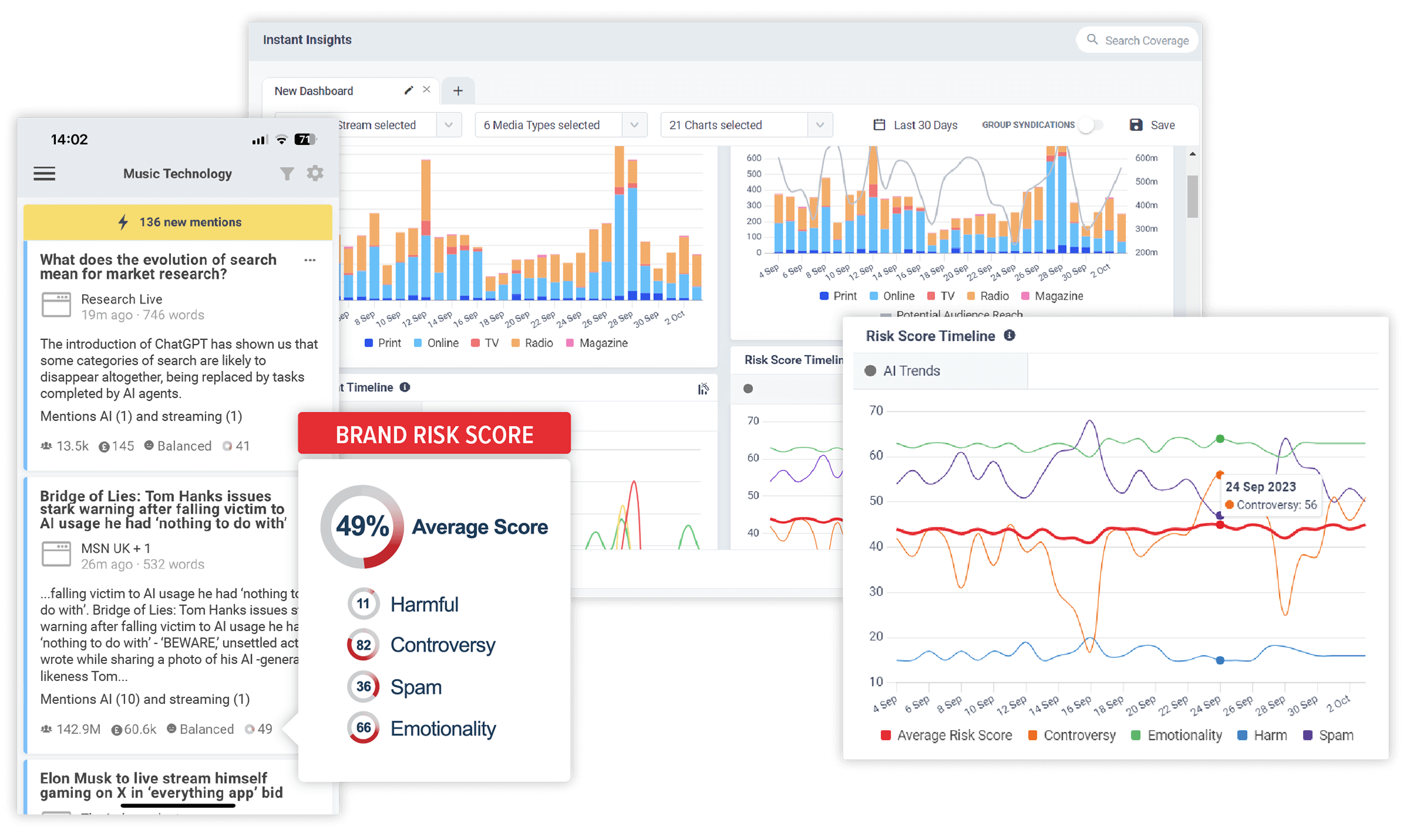

Discover the stories that impact your brand. In realtime.

CisionOne delivers relevant news, trends and conversations that matter to your brand with the world’s most comprehensive media monitoring service across Print, Online, TV, Radio, Social, Magazines, Podcasts and more.