About

Bio

Background and Format:

Zephus is a database of deal information. It contains information on M&A, IPO, private equity and venture capital deals and rumours. Moved to the Free Trade Exchange Building in Manchester in October 2011. Press releases can be viewed at www.bvdinfo.com/en-gb/about-us/press-releases. It is aimed at Professionals specialized in M&A. There is no advertising space.

Email

email@cision.one

Website

site@cision.one

Social media

Location

United Kingdom

Frequency

upgrade

Circulation

upgrade

Sectors

Mergers & Acquisitions

Bio

Background and Format: Zephus is a database of deal information. It contains information on M&A, IPO, private equity and venture capital deals and rumours. Moved to the Free Trade Exchange Building in Manchester in October 2011. Press releases can be viewed at www.bvdinfo.com/en-gb/about-us/press-releases. It is aimed at Professionals specialized in M&A. There is no advertising space.

Website

Social media

Location

Frequency

Circulation

Sectors

Mergers & Acquisitions

Most recent articles by Zephus

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Explore outlets similar to Zephus

-

Mergermarket

MergermarketBackground and Format Mergermarket is a subscription-based, round-the-clock news wire service - similar to The Associated Press, Bloomberg and Reuters - that caters exclusively to the global investment community, with more than 300 reporters and 120,000 world-wide subscribers. Articles are posted to the secure website 24/7 and also delivered via e-mail and mobile device alerts. Their journalists are based in 65 locations across the Americas, Europe, Asia-Pacific, the Middle-East and Africa, and report mainly on corporate growth strategy via interviews with CEOs of public and private companies, focusing mainly on how their company plans to grow in the next two years: organically, inorganically - or a combination of both? What are its core products and services? What makes it unique? How is it competing in today's market? What economic, political and regulatory factors are driving growth or consolidation in the space? They also write trend and analysis pieces based off these and other conversations with industry sources. Mergermarket, a former division of The Financial Times, is now a portfolio company of London-based BC Partners. They are based in New York, the UK, and Hong Kong, and 100% funded by subscribers. Audience and Readership For those involved in mergers and acquisitions who require intelligence and news including corporations; investment banks, private equity and venture capital firms; and law firms, accounting firms and other advisors Monthly Unique Users Source: Publisher. Other Information The best way for PRs to help is by setting up interviews and meetings with CEOs and M&A practitioners. When getting in touch, PRs should go directly to the reporters across the different sectors. Gorkana Meets… Beranger Guille, Editor EMEA, Mergermarket 12 June 2015 The write up can be found here Gorkana UK Financial Alert: Tuesday 11th July 2017 Mergermarket Group, a provider of business intelligence and research for fixed income, transactions, infrastructure, compliance and equities, has relaunched under the brand name Acuris. The company is globally recognised through its portfolio of brands, with 700+ reporters, analysts and developers covering financial markets throughout Europe, Asia and America. Acuris has 17 offices globally, including three headquarters in London, New York and Hong Kong. The full announcement can be found here. Gorkana Alert: Tuesday 2 June 2015 Mergermarket Group has moved to a new address. The media company, which publishes among other titles Debtwire CEEMEA, an online publication providing news and data on high yield, distressed and restructuring situations in the CEEMEA region, is now based at 10 Queen Street Place, London, EC4R 1BE. The switchboard number is +44 (0)20 3741 1188. Gorkana Alert: Monday 8 December 2014 Arezki Yaïche has been appointed as a Financial Journalist based in Paris, France, covering small and midcap companies for the international financial newswire Mergermarket. He was previously a

View American Banker

American BankerEstablished in 1891 and formerly known as U.S. Banker, American Banker is targeted at professionals in the financial services industry throughout the United States. They help readers to understand the undercurrents in the industry, and to give them a comprehensive look at where the banking industry is headed. Highlights include how major industry players are dealing with new changes to the world of banking, plus news and technological developments in the banking industry, in addition to reports on companies, personalities, and industry trends. Each issue covers the areas of asset management; community banking; corporate and institutional banking; customer acquisition and retention strategies; debit and credit cards; marketing, branding. and advertising; mergers and acquisitions; mortgages; regulation and policy; retail banking; risk management; small business lending and services; and technology developments. Each issue features banking industry related sections, headlined by the Annual Rankings, which includes American Banker’s Top 25 Women in Banking and the acclaimed All-Star Banking Team: a ranking of the top CEOs, Banks, CMOs, Retail Teams, Chief Economists, Mergers and Acquisitions Advisers, and more. American Banker Magazine DOES ACCEPT byline articles/submissions. Contact the editors.

View FundFire

FundFireFundFire.com covers the institutional investment and high net worth asset management industries, both nationally and globally. It is updated daily and is geared towards asset management professionals, plan sponsors, and institutional investors. Articles cover pension funds, hedge funds, mergers and acquisitions, corporate leaders, real estate equity, and retirement planning options. Access to the site requires a subscription. Fundfire.com is updated daily. There is no deadline for press releases, but the editor requests that they be sent as soon as possible as the site competes with several other financial Web sites. The site accepts press releases sent by e-mail to editorial@fundfire.com. FundFire.com will only disclose traffic and circulation rates once a prospective PR or advertising company has personally contacted the site. Contact the advertising department for advertising rates. The site does not publish an editorial calendar. FundFire covers people moves on a rotation basis. Feel free to send the press release to an Editor who will make sure it gets to the person for that time. FundFire DOES accept bylined articles/submissions. It cant be a promo for the writer. It must make a specific point and back up the point. It can not be too technical, for example, it can’t go too deep into issues such as mean variance or Black Scholes. It should be about 600 words to 700 words. Contact the interactive editor. Media Alert: Wednesday 29th April 2009 Bright Ideas is a new interactive feature on FundFire highlighting the latest strategies for surviving and thriving in a rapidly changing marketplace. Since March, it has published a weekly series of tips from across the institutional and high-net-worth asset management space which focuses on career development, sales, marketing and operations. Stories will be updated with reader comments as they come in to brightideas@fundfire.com

View The Deal

The DealThe Deal is written for corporate and technology dealmakers, their advisers and investors. Editorial content covers financial transactions like venture capital, IPOs, private equity, M&A and bankruptcy/restructuring. Also includes analysis, profiles and information on financial, technological, legal and accounting structures of newsworthy organizations. Analysis includes insight into deals as they evolve and shape the world's markets. Offers perspective on a range of financials transactions and the dealmakers behind them through its signature columns, scoreboard charts, tables and comprehensive sections. Pitch Notes: Send details of breaking news immediately, they do respect embargoes. They will cover all sizes of companies but prefer larger deals. Deals must be above $1Million. They like speaking with C-Level executives with knowledge of all details of the deal. Include $amount, company information and the identity of the investors. Contact editors with general queries. Pitch reporters and journalists for daily news stories. They all prefer contact by email. Topics Covered Include: Mergers & acquisitions, auctions, financings, bankruptcies & restructurings, antitrust & regulation, international markets, middle market, private equity, corporate governance and IPOs. The Deal DOES accept bylined articles/submissions.

View Buffalo Business First

Buffalo Business FirstWritten for the business community of Buffalo and Western New York, Buffalo Business First emphasizes breaking business news, financing, management analysis, and editorial comment. Targeted at managers and executives responsible for making important business decisions, the publication features local business news and information from around the region, aims to provide information which helps businesses conduct business more effectively, and features specialized reports along with new business leads for readers. They are part of 40+ other local business journals, owned by parent company American City Business Journals.

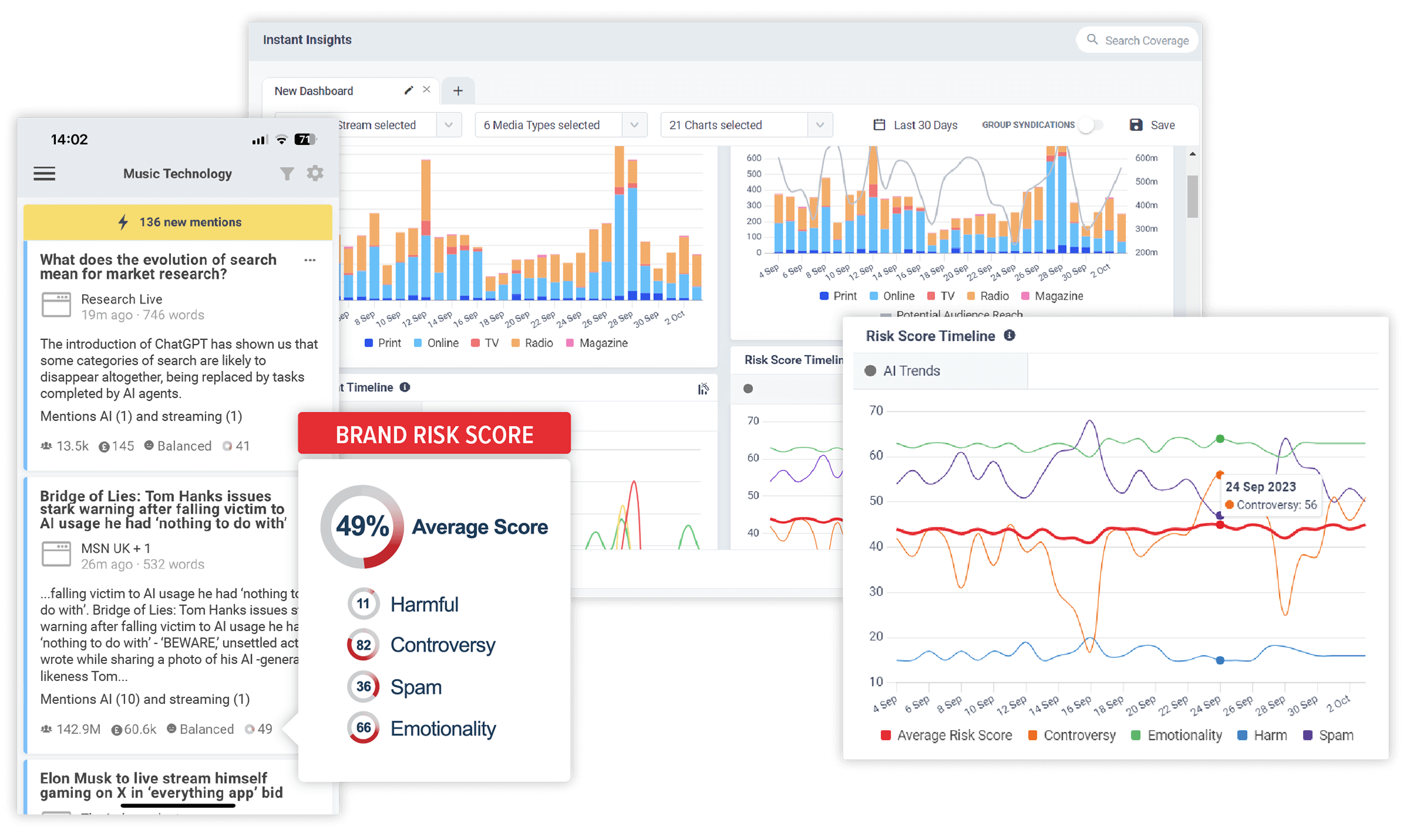

ViewUse CisionOne to find more relevant outletsDiscover the stories that impact your brand. In realtime.

CisionOne delivers relevant news, trends and conversations that matter to your brand with the world’s most comprehensive media monitoring service across Print, Online, TV, Radio, Social, Magazines, Podcasts and more.