About

Bio

Background and Format:

International Tax Review is a magazine serving the international corporate tax community and is an essential resource for corporate tax directors and executives, chief financial officers, tax lawyers and advisers, and officials. International Tax review provides current analysis of tax changes, the latest deals and topical issues dominating the tax world. International Tax Review provides corporate tax directors with the implications of tax changes around the world, to their business. From both an industry and topic viewpoint, they give the view of fellow industry tax professionals, the revenue authorities and advisers, globally. International Tax Review provides practitioners with insight into what their clients are reading, as well as the views of other tax advisers on key topics.

Audience and Readership:

International Tax Review is read by tax practitioners from both corporate and private practice.

Deadline:

Press deadline is on the 12th of each month.

Time of Publication:

Towards the end of each month.

Frequency:

Published 10 times per year with two double issues, December/January and July/August.

Circulation:

Figure not disclosed by publisher.

Ad Rates:

The media pack is available here.

Email

email@cision.one

Website

site@cision.one

Social media

Location

United Kingdom

Frequency

upgrade

Circulation

upgrade

Sectors

Tax Law

Bio

Background and Format: International Tax Review is a magazine serving the international corporate tax community and is an essential resource for corporate tax directors and executives, chief financial officers, tax lawyers and advisers, and officials. International Tax review provides current analysis of tax changes, the latest deals and topical issues dominating the tax world. International Tax Review provides corporate tax directors with the implications of tax changes around the world, to their business. From both an industry and topic viewpoint, they give the view of fellow industry tax professionals, the revenue authorities and advisers, globally. International Tax Review provides practitioners with insight into what their clients are reading, as well as the views of other tax advisers on key topics. Audience and Readership: International Tax Review is read by tax practitioners from both corporate and private practice. Deadline: Press deadline is on the 12th of each month. Time of Publication: Towards the end of each month. Frequency: Published 10 times per year with two double issues, December/January and July/August. Circulation: Figure not disclosed by publisher. Ad Rates: The media pack is available here.

Website

Social media

Location

Frequency

Circulation

Sectors

Tax Law

Most recent articles by ITR

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Article description

Explore outlets similar to ITR

-

TThe Chronicle of Philanthropy

The Chronicle of Philanthropy provides news and information for non-profit executives, fundraisers, and professional employees of foundations. The publication covers trends in giving, fundraising, grant making, volunteers, management and professional development. Regular features include profiles of foundations, updates on federal and state regulations, tax and court rulings, and a calendar of events. Unless something is urgent, they prefer contact by email rather than phone. Press Releases should be relevant to nonprofit practitioners across the country, and if there's been a recent article about a similar development at a different organization, they probably won’t cover it again soon. They like: stories about best or innovative practices in fundraising and managing organizations, profiles of interesting charity leaders, fundraisers, and donors, and new trends in giving or fundraising. They usually don’t cover: galas, celebrity events, groundbreakings and ribbon cuttings, and gifts of less than $1 million. The Chronicle’s Opinion section is designed to spark robust debate about all aspects of the nonprofit world. They welcome Op-Ed submissions that provide new insights and promote innovative thinking about leadership, fundraising, grant-making policy, and more. They especially appreciate articles about timely topics. Most of the pieces are about 1,000 to 1,200 words.

View Thomson Reuters Foundation

Thomson Reuters FoundationBackground and Format The Thomson Reuters Foundation, the charitable arm of Thomson Reuters, covers the world’s under-reported stories, with a global team of about 40 staff journalists on humanitarian crises, women’s empowerment, the human impact of climate change, property rights, and trafficking and slavery. All of its stories are published on its news website, news.trust.org, as well as distributed on the Reuters news wire.

View Tax Notes

Tax NotesServes tax practitioners and policymakers with inside information on critical tax law information and important policy changes. Provides comprehensive coverage of tax news and issues. Features in-depth articles, special reports and commentary analyzing proposed and enacted tax legislation, court decisions, regulations and other administrative guidance and new trends in the administration of tax law. Contains articles by tax experts as well as the nation's leading practitioners, academics and policy experts. Tax Analysts, publisher of Tax Notes, does NOT release readership or circulation numbers. Tax Notes DOES accept bylined articles/submissions via their website.

View Tax Analysts

Tax AnalystsGeared toward tax attorneys, policymakers and tax professionals. Covers state, federal and international tax laws and issues. Helps the country tax its citizens fairly, simply and efficiently and to stir up great tax policy debate and fuel it with the best news and commentary.

View The Law Society Gazette

The Law Society GazetteBackground and Format:Launched in 1903, The Law Society Gazette is published by the Law Society weekly and is aimed at solicitors, barristers, trainees and aspiring lawyers aiming to practise or are practising in England and Wales. Covers news, comment, features, in practice, personal injury, property law, risk & compliance, cybersecurity, profiles, movers and features called My Legal Life. For more information about advertising rates, the team can be reached on +44 (0)20 7841 5542/3Circulation:Source: ABC.

ViewUse CisionOne to find more relevant outletsExplore journalists that write for ITR

Contact us to find more relevant journalistsDiscover the stories that impact your brand. In realtime.

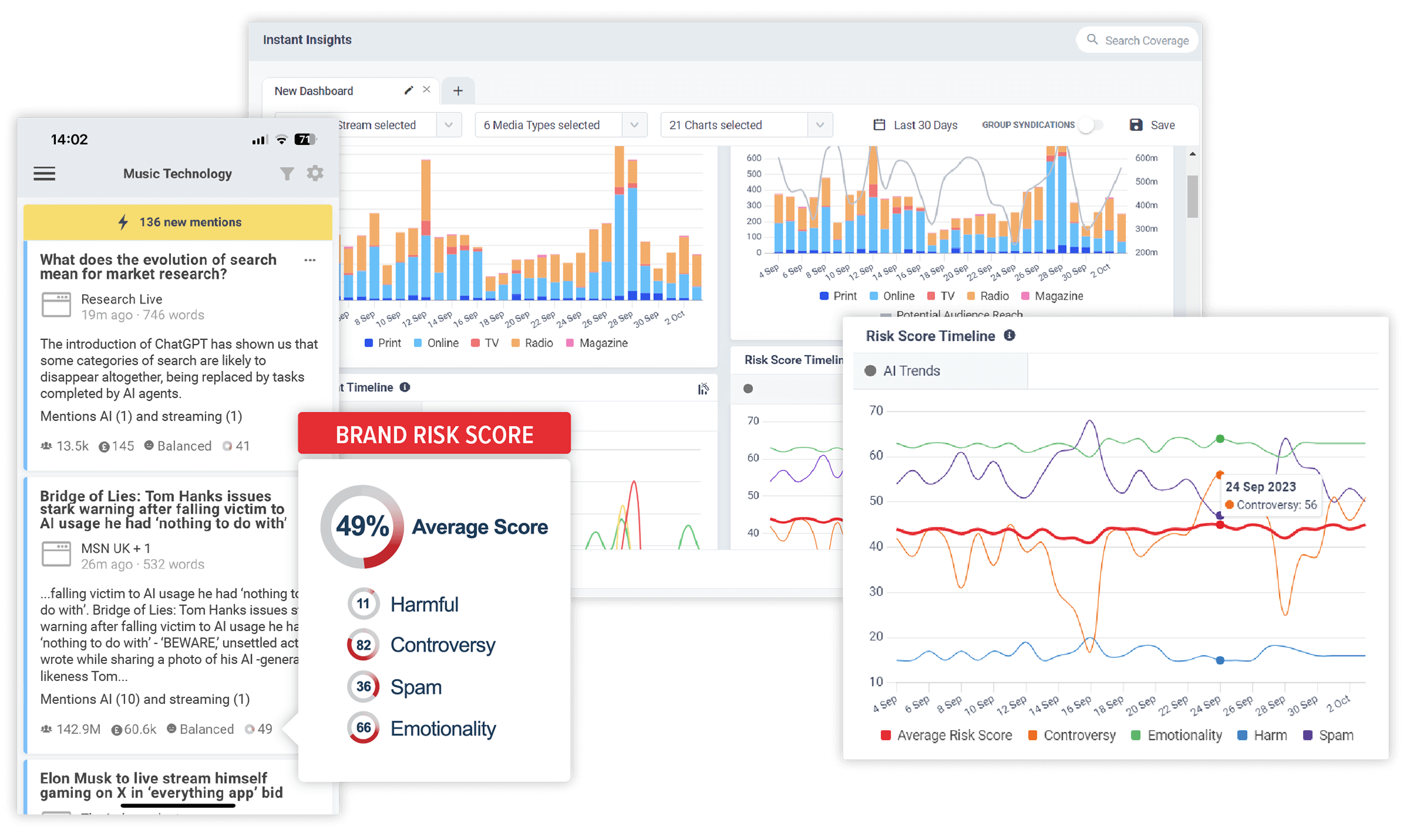

CisionOne delivers relevant news, trends and conversations that matter to your brand with the world’s most comprehensive media monitoring service across Print, Online, TV, Radio, Social, Magazines, Podcasts and more.